One place to track, translate, and transfer your cyber risk.

Resilience’s integrated cyber risk solutions connect risk quantification software, cybersecurity experts, and A+ rated cyber insurance, all purpose-built for middle and large organizations.

Comprehensive Coverage Meets Proactive

Risk Management.

The Five Integrated Benefits of the Resilience Solution

Quantified Action Plan

Financial context and prioritization for better and faster operational decision-making.

Cyber Advisory Program

Expert counsel to guide, validate, and augment your cyber risk team.

Human-in-the-Loop Partnership

Proactive engagement throughout the policy lifecycle to keep you ahead of potential losses.

Financially-Proven AI Platform

Continuous learning system that creates clarity by providing cybersecurity visibility.

Responsive Policy

Comprehensive coverage, purpose-built for the dynamism & complexity of enterprises.

|

State of Your Risk Analysis summarizes and quantifies your comprehensive cyber risk profile

|

|

|

|

Breach & Attack Simulations tests to validate security posture in minutes

|

|

|

|

ROI-prioritized Cyber Action Plan to translate cybersecurity controls and threats to financial risk

|

|

|

|

State of Your Vendor Risk Analysis summarizes insights on vendor’s cyber risk assessment (up to 15 vendors)

|

|

|

|

Best practices and “how to” cyber risk management guides and governance policy templates

|

|

|

|

Incident response and lifecycle management plan for review and validation

|

|

|

|

Annual strategic tabletop exercise (TTX) focused on an organization’s leadership response to a major cyber event

|

|

|

|

Quarterly meetings with our industry-leading cybersecurity and cyber risk experts

|

|

|

|

Cyber Resilience Onboarding for the organization’s key stakeholders

|

|

|

|

In-house claims & incident management available 24/7

|

|

|

|

Expert-triaged critical notifications on the most financially damaging cyber threats and vulnerabilities, leveraging the industry’s first Risk Operations Center

|

|

|

|

The Edge Engagement Summary showcasing your risk mitigation efforts, providing actionable insights on loss reduction, and communicating key outcomes to executives

|

|

|

|

Ongoing visibility into external attack surface risk and dark web exposure

|

|

|

|

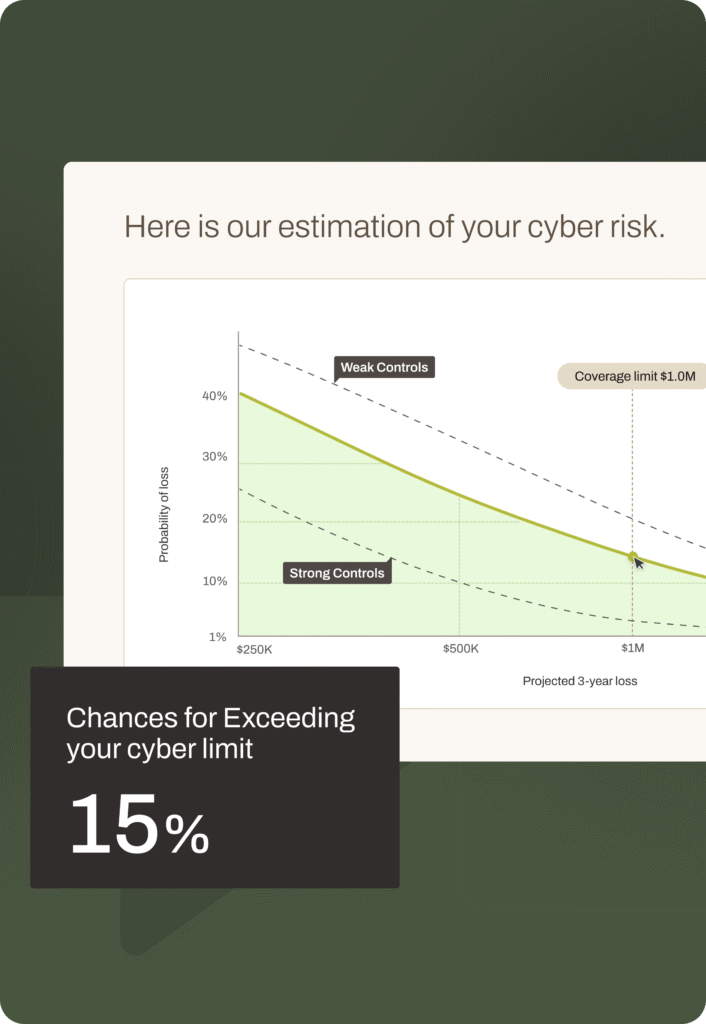

State-of-the-art quantification models that measure financial costs and guide strategies to reduce the likelihood of significant losses

|

|

|

|

Review and update security controls data to build an enhanced Cyber Risk Profile

|

|

|

|

Cloud-based assets risk monitoring for AWS, M365, and Zscaler Internet Access

|

|

|

|

Streamlined & comprehensive cyber insurance policy that covers costs, loss, and liability

|

|

|

|

Technology E&O coverage addressing the complexities of technology-related risks

|

|

|

|

Improved coverage, limits, and retention based on ongoing engagement

|

|

|

|

Hassle-free renewal that bypasses long-form applications

|

|

|

Quantified Action Plan for better and faster operational decision making

State of Your Risk Analysis summarizes and quantifies your comprehensive cyber risk profile

Breach & Attack Simulations tests to validate security posture in minutes

Cyber Advisory Program resources to engage your organization

Best practices and “how to” cyber risk management guides and governance policy templates

Incident response and lifecycle management plan for review and validation

Human-in-the-Loop Partnership to guide and augment your cyber risk team

Cyber Resilience Onboarding for the organization’s key stakeholders

In-house claims & incident management available 24/7

Expert-triaged critical notifications on the most financially damaging cyber threats and vulnerabilities, leveraging the industry’s first Risk Operations Center

Financially Proven AI Platform creates clarity from cybersecurity visibility

Ongoing visibility into external attack surface risk and dark web exposure

State-of-the-art quantification models that measure financial costs and guide strategies to reduce the likelihood of significant losses

Review and update security controls data to build an enhanced Cyber Risk Profile

Cloud-based assets risk monitoring for AWS, M365, and Zscaler Internet Access

Responsive Policy purpose-built for the complexity of enterprises

Streamlined & comprehensive cyber insurance policy that covers costs, loss, and liability

Technology E&O coverage addressing the complexities of technology-related risks

Quantified Action Plan for better and faster operational decision making

State of Your Risk Analysis summarizes and quantifies your comprehensive cyber risk profile

Breach & Attack Simulations tests to validate security posture in minutes

ROI-prioritized Cyber Action Plan to translate cybersecurity controls and threats to financial risk

State of Your Vendor Risk Analysis summarizes insights on vendor’s cyber risk assessment (up to 15 vendors)

Cyber Advisory Program resources to engage your organization

Best practices and “how to” cyber risk management guides and governance policy templates

Incident response and lifecycle management plan for review and validation

Annual strategic tabletop exercise (TTX) focused on an organization’s leadership response to a major cyber event

Quarterly meetings with our industry-leading cybersecurity and cyber risk experts

Human-in-the-Loop Partnership to guide and augment your cyber risk team

Cyber Resilience Onboarding for the organization’s key stakeholders

In-house claims & incident management available 24/7

Expert-triaged critical notifications on the most financially damaging cyber threats and vulnerabilities, leveraging the industry’s first Risk Operations Center

The Edge Engagement Summary showcasing your risk mitigation efforts, providing actionable insights on loss reduction, and communicating key outcomes to executives

Financially Proven AI Platform creates clarity from cybersecurity visibility

Ongoing visibility into external attack surface risk and dark web exposure

State-of-the-art quantification models that measure financial costs and guide strategies to reduce the likelihood of significant losses

Review and update security controls data to build an enhanced Cyber Risk Profile

Cloud-based assets risk monitoring for AWS, M365, and Zscaler Internet Access

Responsive Policy purpose-built for the complexity of enterprises

Streamlined & comprehensive cyber insurance policy that covers costs, loss, and liability

Technology E&O coverage addressing the complexities of technology-related risks

Improved coverage, limits, and retention based on ongoing engagement

Hassle-free renewal that bypasses long-form applications

Frequently Asked Questions

What is Cyber Resilience?

Cyber Resilience focuses on quantifying cyber exposure and prioritizing strategic objectives that matter most to limiting financial loss from a cyber incident. As opposed to traditional cybersecurity approaches, cyber resilience focuses on how business opportunity and risk mitigation work together and support making informed trade-offs when necessary. We have seen how these alignment of objectives can help organizations greatly reduce to exposure to extortion attempts and reduce total costs of incidents when implemented correctly.

How does Resilience provide visibility into the client’s cyber risk?

The Resilience Solution utilizes over 180 data signals to offer clients a comprehensive risk assessment, including external attack surface exposure and self-reported information. In addition, Resilience offers continuous cyber risk assessment by integrating with 3rd party cloud services through APIs, resulting in faster and more accurate risk analysis.

What does the cyber risk solution cost?

We are pleased to offer our clients the Essential Solution at no extra charge from their insurance premium. Additionally, we offer advanced cyber risk management services through our Edge Solution, which requires an annual fee to access. These premium offerings provide exceptional value and are not included in the base package.

How difficult is this to roll out?

Resilience experts want to make this process seamless for you and your team, which is why we are available to help every step of the way. We offer comprehensive onboarding for key stakeholders, regular engagements to help enact your cyber hygiene plan, and more.

Do I really need a cyber resilience solution?

In today’s highly digital environment, building resilience against cyber threats is paramount to business success. Cyber insurance and security are no longer effective when working in silos. Connecting advanced cybersecurity visibility to enhanced and modular insurance policies via actionable cyber hygiene strategies is the strongest way to combat the complexities of cyber risk.

Can Resilience help in an emergency?

Absolutely. Our in-house claims team is available 24/7 to handle any of our clients’ cyber emergencies. If you are experiencing an incident, 1-(302) 722-7236.