SAN FRANCISCO, CA – May 13, 2025 – Resilience, a leader in cyber risk solutions, today launched the industry’s first Cyber Risk Calculator to provide organizations with a financial snapshot of their cyber risk. The AI-powered tool provides security and risk practitioners and C-Suite executives alike with a common, data-driven language to better understand and quantify their cyber risk. The Cyber Risk Calculator uses industry benchmarks to help stakeholders understand their risk exposure and potential financial losses due to cyber-related incidents.

Existing strategies for understanding cyber risk, such as heat maps, focus on vague ratings that don’t adequately translate cyber risk into financially tangible terms. As smarter threat actors, AI-powered hacking capabilities, and increased interdependence introduce new variables to the threat landscape, teams want to prioritize their cyber business decisions to control losses. And as third-party risk skyrockets—with Resilience’s own research finding that vendor-related cyber insurance claims led to losses for the first time ever last year—companies are tasked with assessing not only their own security postures, but that of their partners, too.

“Most businesses know that today’s threat landscape is evolving rapidly. But very few understand what this evolution means for their company, and fewer still have the tools necessary to take meaningful action to protect themselves. This is the gap our Cyber Risk Calculator fills,” said Vishaal “V8” Hariprasad, Co-Founder and CEO of Resilience. “The user-friendly tool offers unprecedented visibility into a company’s cyber exposure against industry benchmarks and visually demonstrates how cybersecurity investments can reduce that exposure. Ultimately, the calculator empowers security practitioners to translate complex technical vulnerabilities into clear financial terms, so the C-Suite can make smarter, data-driven cybersecurity investment decisions.”

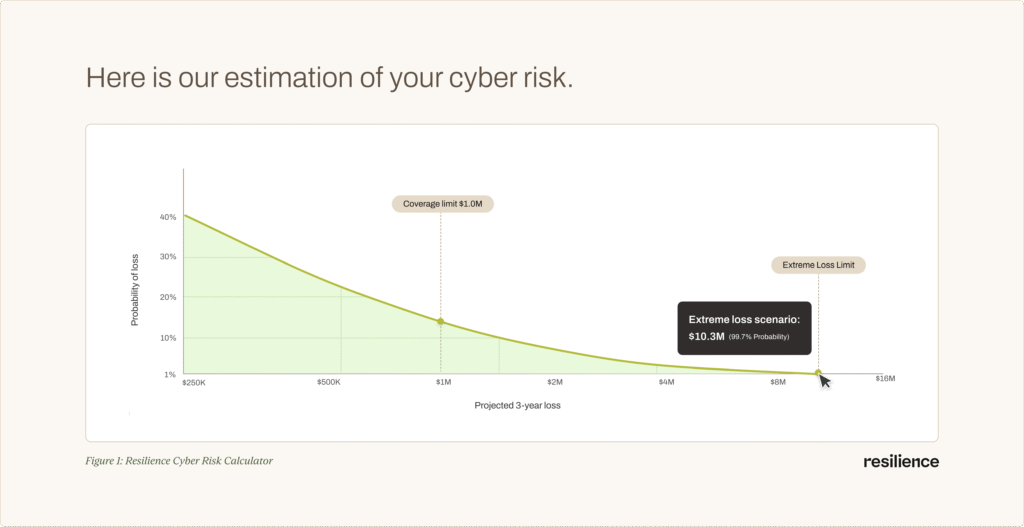

The Cyber Risk Calculator asks six simple questions about a user’s organization, then creates a financial loss projection based on key firmographic data points and desired insurance limits. Then, the calculator provides a high-level estimate of potential cyber risk, expressed in real dollar terms; an initial assessment of risk exposure versus risk tolerance; and a cyber risk projection based on proprietary industry benchmarks.

This personalized, data-driven approach is crucial. The calculated cyber risk of Resilience manufacturing clients, for instance, varies by up to a staggering 35% based on their handling of key risk factors like multi-factor authentication (MFA), backups, and vendor management.

“For too long, CISOs, CFOs, and risk managers have spoken different languages, stalling critical cybersecurity investments and leaving companies vulnerable. Drawing from our unique bird’s-eye-view of the threat landscape, extensive underwriting capabilities, and proprietary Risk Operations Center, we built a tool that bridges this communication gap,” said Dr. Ann Irvine, Chief Data and Analytics Officer at Resilience. “Now, businesses can have a common language that everyone can understand—from the server room to the boardroom. Armed with learnings from the Cyber Risk Calculator, they can align technical, financial, and operational staff around the shared goal of meaningfully reducing organizational risk.”

The Cyber Risk Calculator is an introductory tool that helps any business understand its cyber risk in financial terms. It leverages a portion of the intelligence built into Resilience’s award-winning cyber business decision platform. Available commercially via cyber insurance brokers, Resilience offers cyber risk solutions to fit the needs of clients from $50 million in annual revenue to greater than $10 billion.

The Cyber Risk Calculator is free to use and available now here.

Disclaimer: This content and the projections from the Cyber Risk Calculator are for informational purposes only. Neither should be considered exhaustive or fully accurate estimation of risk, nor do they constitute insurance advice. Neither this content or the Cyber Risk Calculator constitutes a solicitation, offer, or recommendation of any Resilience insurance product. To determine the appropriate insurance coverage for your organization, please consult your broker.